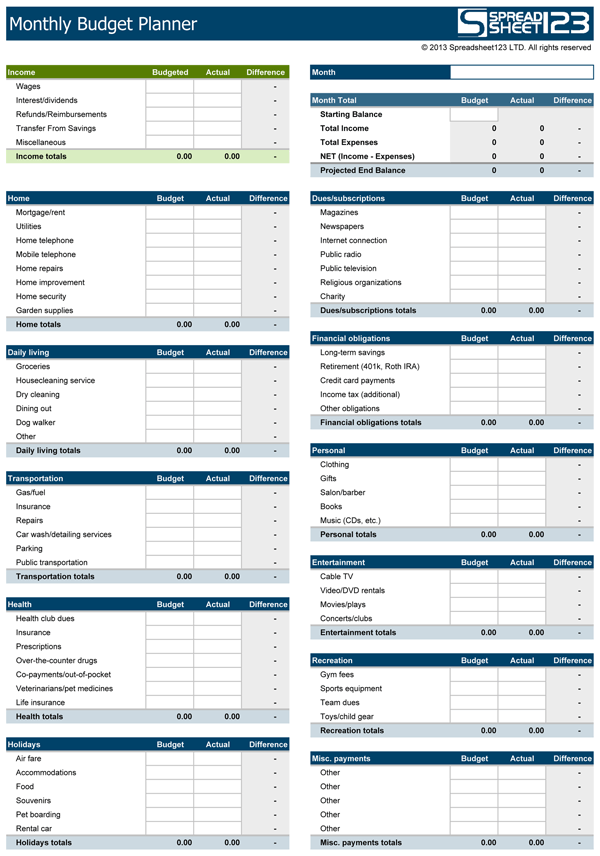

The more you use your budget, the more accurate it will be.Ĭreating a budget from scratch doesn’t have to be difficult. Budgeting is about making yourself aware of the money coming in and going out of your life.ĭon’t worry if your budgeted and actual income and expenses vary. You may need to adjust your budget to account for emergency spending or unplanned income. How to Manually Import Your Bank Data into Your SpreadsheetsĪs your chosen budget period progresses, be sure to regularly update your budget spreadsheet with all of your actual transactions.Look through the last few months of bank records to see where your money is actually going. Your historical financial data is a great jumping-off point for creating your budget. However, within the parameters of your income, you can decide how to spend your money. Your income puts a hard limit on your allowable expenses. Step 5: Input your budget numbers.Ĭreating a budget is nothing more than setting financial goals. You can also vertically sum all of your income and expense categories by using the SUM formula. You can figure the difference between your budgeted and actual income and expenses by subtracting the cell containing the “actual” amount from the cell containing the “budget” amount. Manually summing cells is time-consuming, but Google Sheets makes it easy with formulas. Step 4: Use simple formulas to minimize your time commitment. A column showing the difference between the two, so you can see a complete picture of your progress.A column for actual income and expenses.A column for your budgeted income and expenses.Regardless of the budget period, you’ll want to create three columns: They then extrapolate the budget out to a year.

In fact, most budget apps and software track income and expenses by month. You can also use multiple budget periods simultaneously.

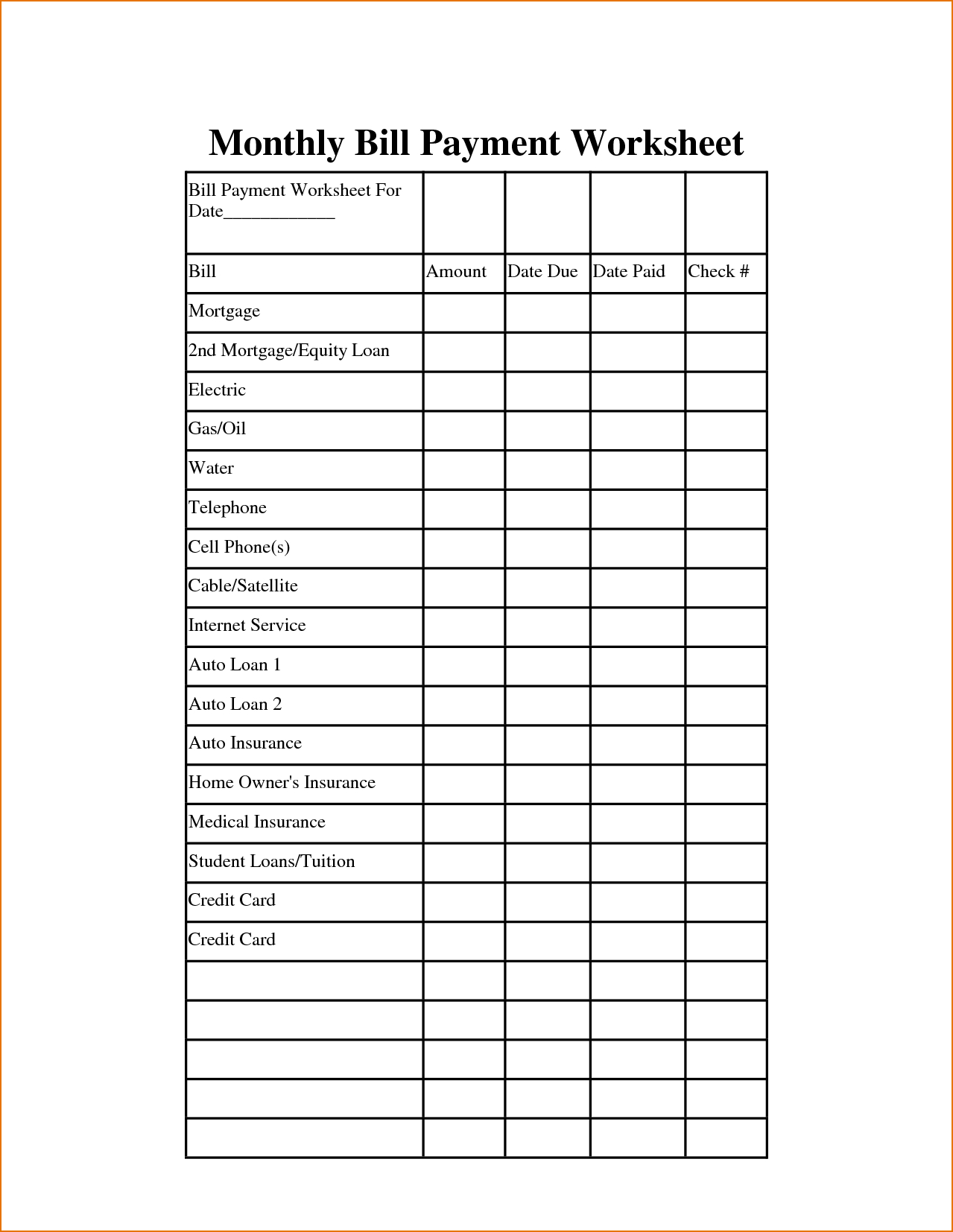

How much time you want to spend updating your budget spreadsheet.How closely you want to monitor your finances.You may want to budget daily, weekly, bi-weekly, monthly, or yearly. This is especially helpful if you’re trying to reduce your expenses in a specific area of your finances. If you find that specificity helps you maintain better control of your finances, you may want to add subcategories to more closely track certain expenses. However, you want enough categories to encompass all your income and expenses without creating unnecessary complexity. There isn’t a “right” number of categories. Step 2: Create Income and Expense CategoriesĬategories are the backbone of a budget.

0 kommentar(er)

0 kommentar(er)